We’ve all heard about credit scores, but not many of us know exactly how they work or why they benefit us. After having many conversations with others, I want to offer a refresher on credit scores, how they work–and how you can hack them for greater financial freedom.

With greater “financial freedom” granted with a high credit score, you could screw yourself later if you haven’t developed responsible financial behaviors. If you aren’t accustom to having large amounts of credit extended to you, you might feel compelled to spend it. And when you spend beyond what you can repay, this is where debt happens. Not knowing about your credit scores or taking an active role in managing it can become shackles that hold you back from living life not in debt. Credit scores are not the end-game; however, they are the only three-digit set of numbers that will communicate your ability to honor your debts to current and future lenders.

What is a credit score?

A credit score is a numerical representation of your credit (lending) history. It does not mean you are wealthy. One could be flat broke with zero net-worth and have an outstanding credit score. Or, one could have access to millions of dollars in the bank, but have a poor credit score. Credit scores measure your ability to maintain a positive (not negative) relationship with lenders. Credit scores are the mathematical interpretations of your credit report, and they vary depending on the nature of your potential loan.

Credit scores are based on your credit report. Credit reports are provided primarily by three credit reporting agencies (CRAs). There are three CRAs: Experian, Equifax, and TransUnion. Lenders fund these agencies since they access their data to identify prospective customers and may routinely pull your credit report through “soft” inquiries, or if you apply for new credit, they conduct a “hard” inquiry. (Soft inquiries don’t hurt your score; hard inquiries do and they last two years.)

Credit scores are compiled via analytics firms like FICO or VantageScore. They access the data from CRAs and license their scores to other providers that display the score to consumers or lenders. Understanding how the credit reporting agencies function is important because they directly influence your credit score. While scores may vary widely, they are loosely based on the related factors sourced from your credit report.

What goes into a credit score?

Credit scores are calculated independently for each credit reporting agency and each lending type. In short, there isn’t only one score for a person at any given time. FICO is regarded as the most reputable among lenders as they assess risk differently for different types of loans.

Some loan types include credit cards, personal loans, auto loans, home loans, and so on. Imagine that a bank needs to fairly assess whether someone will default or be able to repay satisfactorily, they probably would weight certain criteria differently. Don’t imagine it; it’s exactly how lenders measure one’s risk when seeking credit.

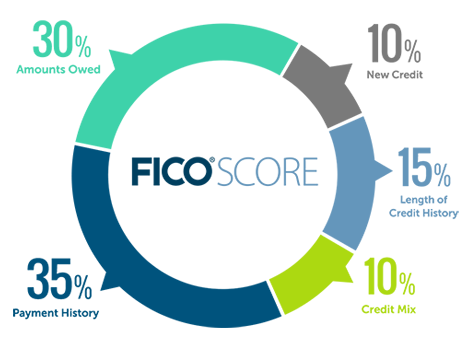

The FICO scoring model is similar to that of most scoring models, so let’s take a look.

- Amount owed – Often called “utilization,” The percentage of debt owed compared to credit available. For instance, a $1000 balance on a $2000 credit card would be 50%. Optimally, you want to be between 5% and 20% utilization.

- New credit – This measures the recency of acquiring any new credit or loans.

- Length of credit history – Also known as “Average age of Accounts (AAoA)”, this averages the overall length of credit.

- Credit mix – To a lender, it is preferred that you have at least an installment account (mortgage, auto loan, etc.) along with revolving credit (credit cards).

- Payment history – Arguably, one of the most important factors, is to ensure that you are not behind on your financial obligations. Collections, judgments, and even late payments will dramatically hurt your score.

If you have some major issues with your credit, your first objective will be to cure the negatives on your report immediately. I’ve found that the MyFICO forums offer about 85% useful information and 15% folklore, so prepare to do a lot of research and get familiar with the dispute process.

Once you address the derogatory items in your credit report, you’re now ready to hack your credit score.

Why hack a credit score?

You’re in total control over your credit score, no matter if it’s in the 500s or the 800s. The cost of poor credit is massive. You will pay higher interest, require larger down payments, and ultimately life will cost you more than someone who has excellent credit. I use the term “hack” since a series of small actions can make a huge difference in your credit score. I do not suggest undertaking anything that is inherently unethical or illegal.

The game of credit scores never ends. You might have an 800 credit score one week and a 730 the next. The good is that lenders typically care about ranges, so don’t get obsessed with the particular number. FICO scores range from 300 to 850, but if you’re above 720, you’re doing very well.

How to hack your credit score?

- Gather data.

Your first objective is to acquire your credit reports. If you haven’t done so already, visit AnnualCreditReport.com and download (Save as PDF or similar) all your credit reports from the CRAs. Comb through them and familiarize yourself with the reports and recognize exactly how your accounts are listed. Set yourself up on CreditKarma, WalletHub, Credit.com, and CreditSesame. Don’t worry about those specific scores as they use VantageScore or a “FAKO” score, but do follow the updates and the changes made to your credit reports. If you have a specific purchase in mind (like a house), then it is worth subscribing to MyFICO to pull your reports on a frequent and regular basis. - Optimize your utilization.

Benefit: 20 points

The next objective is to immediately get one or more of your credit accounts to below 30% utilization. This will in itself have a significant impact as the data is updated with the CRAs, on a monthly basis. You can get creative and focus on your lower-balance cards as the data point will be helpful, and you can work your way up to lower the utilization on your cards with higher balances. - Increase your existing credit limits.

Benefit: 30 points

Once your credit reports have been updated (give it about two billing cycles), contact your credit card companies to increase your limits. Different cards and banks have different policies around hard or soft inquiries. A little Googling will go a long way in determining the likelihood of a soft inquiry. And don’t be afraid to call and use the automated credit limit increases (I’ve had great success with that). Depending on your existing credit limit and reported income, seek 2-3X your limit. Don’t request credit limit increases more than once every six months per card. Be responsible and don’t spend it – it’s not your money. Credit limit increases benefit you by increasing your overall access to credit and lowering your overall utilization. - Dispute (or beg) to delete negative account information.

Benefit: 50 points

We all make mistakes with our credit; I know I did, but most mistakes are addressable either by force or by simply being nice. I like to be nice first since it renders no risk to be nice. If you start off aggressive, being nice won’t help you. For instance, I had a small credit account that was in otherwise decent standing, but it had one late payment in five years. I wrote the company a letter informing that I have been a customer in good faith and would like them to update the CRAs that the balance was paid in full and on-time. They replied back with a template stating “we can’t make changes, blah blah blah.” The next billing cycle, the credit report was updated with satisfactory remarks with no lates. Being nice goes a long way. Or perhaps you have a small collection account that you paid in good faith. After trying all means to remove the account from my report, the method that worked was to go through the Better Business Bureau and they removed the negative account entirely since I paid the small sum several months before my request. Do your research, be nice, be patient, and you might succeed. Get familiar with Goodwill letters and how to write letters to executives (since their handlers usually get your reasonable requests to the right department). These efforts won’t always work, but it’s always good to make an honest attempt or few since these marks will hurt you, even more, when you require more sophisticated underwriting. - Become an authorized user.

Benefit: 10 points

If you have a close family member where both of you know the financial health of each other and they have a card with a large credit line, you can become an authorized user. Obviously, if this person has a poor credit history, it benefits neither of you and could damage your credit history. Authorized users don’t get reported exactly as the same as having your own credit, but CRAs consider it as a form of credit that has been extended in some capacity to you. In the old days, you could truly “hack” your credit score with this tactic, but as a result, becoming an authorized user has a less beneficial effect. - Win the game on credit.

Benefit: 5-10 points and cash bonuses

The best way to not pay interest at all no matter your interest rate is to make your principal $0. Pay your cards down to zero or very close to it, so you don’t pay to use the bank’s money. Know that for every purchase you make, interest doesn’t accrue for at least 21 days. While maintaining your existing utilization, your credit will have increased. When you feel comfortable, go ahead and reap your bonuses by applying for credit cards with attractive bonuses based on your introductory spending or other benefits. (Head over to r/churning on Reddit for more guidance.) Be mindful that when you apply and even receive new cards, you will take a beating in your score temporarily, so don’t get carried away.

The goal of hacking your credit score isn’t to have an 800+ credit score.

I admit that I might have sensationalized this process since many people are often looking for a quick fix to improve their credit scores without actually addressing the behaviors that caused them to have poor credit. The goal in ‘hacking’ your credit score is for you to realize that you have control over one of the most significant factors in lending decisions.

Think about the financial goals you have. Purchasing a car, buying a house, starting a business, switching insurance companies, or anything else that requires lenders to pull your credit.

You should be aware that there are limitations to manipulating your credit report. If you have an outstanding charge-off that absolutely can’t be remedied, then you can’t go too far in the credit game. You might even step on landmines that awaken old debtors who resume adverse activity in your life. Make thoughtful, intentional decisions with your financial past so you can enjoy a better financial future. If you’re unsure, consult with a debt collection attorney for a second opinion.

After hacking your credit score, it will eventually become a hobby—not a skeleton—as you achieve your financial goals. And if you gain confidence and greater self-awareness, that’s more valuable than any three-digit credit score.

Photo credit: Republica