Buying a home wasn’t so simple, not for me anyway. Beyond the financial pressure, the market was changing rapidly. It can feel overwhelming. I’ll guide you through the process to buy a house — and give you tips to get it done!

After the recession in 2006, I witnessed my peers lose what they worked so hard to achieve, homeownership. The media covered the great financial and moral conundrums that surrounded the housing and the automotive industries. Some of us might have even been a victim of predatory lending practices, so it wasn’t all doom-and-gloom from the media – some of us lived it.

As you know, the financial crisis had a ripple effect that influenced not only the people who lost or nearly lost their home but also millennials like me. I consider myself between a millennial and a Gen-Xer, but that’s what happens when you were born in 1985. The idea of owning my house felt improbable and risky at best for the past ten years.

After many years of developing financial discipline, I have been able to purchase my home. I learned a great deal through the purchasing process that can help my fellow cohorts who consider themselves millennials.

Why buying a home is difficult for millennials

Think what you want about millennials. Some of us are entitled. Some of us are lazy. I’d argue that many have been and are likely scared. We saw people’s lives turned upside down by major disruptions in the American economy resulting in lost jobs, lost cars, and lost houses. For some, they lost much more. These disruptions don’t take a month or two to normalize; it took by some measures, a decade to remedy.

Personally, I can attest to the fact that I wasn’t cozy, job-hopping, or living a lavish lifestyle with mom and dad. I was happily working at a fast-growing software company and doing my best to perform well. I stayed there for just over seven years, which is almost 60 percent longer than the national average for staying in a job. Was it that I was just overjoyed to drink unlimited amounts of Diet Coke subsidized by them? No. Instead, it was the fact that I struggled to save and get ahead.

While the economy was rebounding and Phoenix was in the top ten fastest-growing real estate markets, so did rental prices. I was spending almost as much as a mortgage every month for a modest living. And as the prices went up by more than 15 percent, I moved. And I did this about three or four times until I grew tired of moving. (Then, I got burgled and had to move again.)

During this time, I was still shell-shocked and concerned about when the next financial crisis would hit. I didn’t look for houses, except casually at best on sites like Zillow. Each time, I was equally excited at what I wanted to live in, but also demotivated because the prospect of homeownership seemed more and more distant. So, I worked and worked; so much, it would consume many nights and weekends. I’m not complaining, but I am offering you a glimpse of what life was like for the past eight or so years.

My first steps when buying a house

After I had moved for what I believe is the sixth time in eight years, my lease was concluding in four months. My work was going well, and I’m happy that I have a healthy relationship. I decided to look again at the idea of becoming a homeowner. I’ve always followed and respected Jay Thompson who ran the Phoenix Real Estate Guy Blog many years ago before he moved on to his career at Zillow. The blog continued to operate successfully after being sold. They had recent blog posts on my local market’s trends and tips for future homeowners.

I configured some searches on Zillow to get the creative juices flowing so I could envision where I wanted to call home. After some thought and nudging from my significant other, I decided to send them an email. In that email, I explained that I was in the market to buy a house as a first-time home buyer and sought their advice and expertise.

A day or so later, they passed my information along to what is now my mortgage lender, Academy Mortgage. It turned out that Shane, my loan officer, remembered me when I was quite active in the local social media scene. His assistant, Gabe, collected my information and began the first steps of my journey to move into my home.

I wasn’t broke, but I wasn’t what you would call wealthy. When Gabe provided me an overview of the different lending programs with acronyms like FHA, USDA, VA, and a dozen other acronyms in the world of lending, it made me dizzy. He suggested we meet for coffee to go through some scenarios. I knew enough to understand what I want and how much I could afford, but I was also open to hearing their recommendations. There are numerous variables to keep track of when shopping for a good rate when buying a house, so the more prepared you are, the better decision you will make.

My meeting with them over coffee was quite informative. First, I got to understand the fundamentals of how numerous home loans work. Second, it was refreshing that they didn’t pressure me into a decision and would provide me with several scenarios so I can get an idea of how all the variables work together in their financial products. It was helpful to get a layman’s understanding of the current mortgage rates, which do fluctuate quite a bit. He also laid out the other financials like taxes, insurance, and other fees to be aware of in the lending process. It was a relief to get these straight facts from someone I could trust.

Third, it was also great to get to know them a bit more and get their insights on the trends in the local and national markets. They also explained how different down-payment programs work and determined if they were a fit for me and my needs.

This consultation was exactly what I needed to understand the key steps, the timeline, and all the moving parts in the buying process.

Finding the right house

I was then introduced to Shar Rundio for my real estate agent.

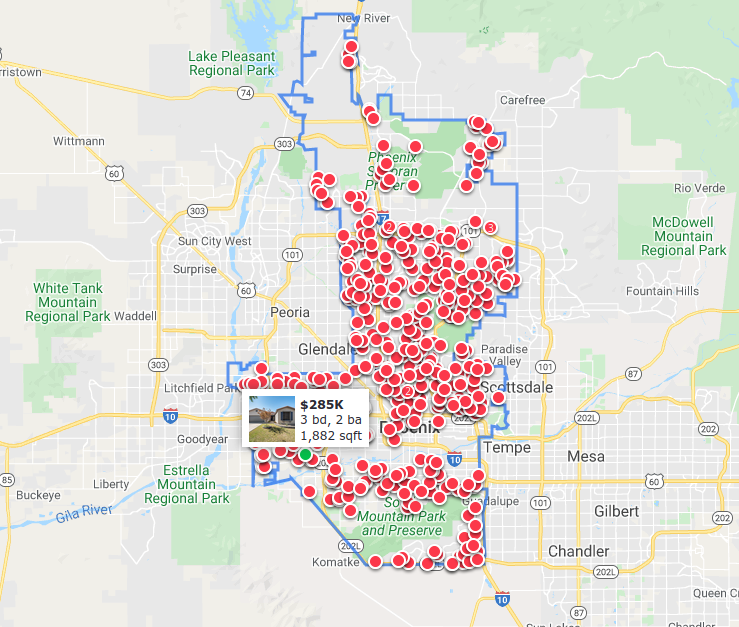

She was nice, and we had a chat about the homes that are available within my price range. She got me set up with a saved search in her MLS app that I could later modify. Day after day and week after week, I was on the hunt for the perfect home. She was a digital native – hell, she uses Snapchat more than I do – and it was very easy to email her about a few properties to research.

I also did my research on property taxes, crime rates, actual crime reports, home values, market trends, proximity to our workplaces, and more. Each house had gone through a rigorous review process before I bothered wasting my time or Shar’s. After narrowing down a list of what seemed like 100 properties down to five, I went searching to scope out the neighborhoods and the houses itself. After a few trips around to different areas of the Phoenix area, I got closer and closer to our goal. Buying a home is a big commitment, so I treated this process accordingly.

Shar checked in with me a few times to make sure I was doing okay because houses would sell quickly just moments after they hit the market. We eventually did a walk through a few houses that we pared down in our search, and she was professional and courteous.

One morning, we visited one house that had potential. Shar was helpful and spoke on our behalf as we examined the inside of someone’s house. After browsing it for several minutes, we concluded it wasn’t a good fit. We visited the next house on my list. Unlike last time, there was a realtor and clients who were already browsing it. What transpired next is why you want to have a realtor on your side.

The other realtor was wrapping up with her clients and put on a display of theatrics including congratulating her clients that they got the house. We remained quiet and non-confrontational and still wanted to look at the house. The other realtor appeared defensive and rather immature for the circumstances. On the other hand, Shar was focused and calm throughout this display. We were impressed with the house even with the possibility it might be sold. We continued to another nearby property with rivaling features and prices. While we were browsing, Shar contacted the seller to confirm if the seller had received an offer and how the deal is going.

To our surprise, no offer was officially made, so the house we wanted was within striking distance. Shar was confident in her approach and laid out the facts for how we proceed. After being disappointed in this third house, we went back to the house we wanted to give it a second look.

My significant other and I discussed it to assess if this is the house we wanted – and it was.

Let’s make a deal

We decided the time was of the essence to make an offer in writing. Shar wasted no time in cracking open her laptop at a nearby Starbucks to begin the digital paperwork. We talked numbers, and she also laid out the next steps for better or worse how the deal might go. We agreed on a buying strategy and would be comfortable with our walk-away price. She crafted the offer with the right language to ensure that we would only pay a slight premium only if it were necessary. We then went home and affirmed our decision, looking at a couple more “maybe” properties, but we assured ourselves this was the right choice.

We waited anxiously all weekend for a phone call, email, or text confirming that the offer was accepted.

It was a time-sensitive offer that was good for the day. We stayed up late hoping the call would come through, but it never did.

The next morning, we saw the MLS service indicated that an offer was accepted. Given our experience, we presumed it was another party with a competitive offer. I checked my email and saw a strange email from Shar with a PDF attached. After opening it, it contained our accepted offer! It was a great feeling that our offer was accepted without paying a premium.

Later that day, Shar explained the next steps in more detail, such as hiring an inspector and other minutiae. A few issues came up in the inspection, and Shar and I divided and conquered on gathering estimates over the following week or so. The excitement and the rush of the deal consumed me as I was sending her two page long emails as a proxy for the seller to read. It was exhausting as the seller wasn’t very forgiving in his negotiations, but we eventually arrived at a number that made sense. Shar applied her expertise on the deal and determined if we should make a concession or not, but was clear that it’s our decision.

We threw a number out to the seller that expedited the deal, and they promptly agreed. I was thrilled, and it showed through the “???!” we exchanged over text.

Lock in the rate and buy

I was prequalified, but the rate wasn’t locked, but now it was time to lock in my rate to get the deal going. Being honest; this process took a bit longer than I wanted. The markets fluctuate. Fractions of a fraction of a percent in interest rates and news on the economy such as job reports and presidential remarks affect how much my loan will cost. Gabe let me know the stage of the funding process and what’s next. (I’m saving you from a lot of boring details.) Eventually, we were ready to lock in the rate.

A couple of days later, Gabe confirmed the rate we confirmed and we were now moving forward (pun intended). Then underwriting had to get all the paperwork done and fund the loan. After getting escrow and a Publisher’s Clearing House-sized check ready, we were ready to sign papers at the title agency. I’m no Dwight Schrute, but I’m telling you, it was a ream of paper.

The house was officially ours!

Once we got our keys, I was mentally exhausted. I was (and am) happy for us. It was the biggest financial decision of my life, and I did it! After moving in and ordering Barro’s Pizza and Dr. Pepper, the moment finally hit when I was thrilled to be home.

A new beginning

As any homeowner will tell you, their job is never truly done. We had a few items that needed timely attention. Of course, I got to work pulling weeds in the front yard. Then learning how to maintain the pool, then getting the utilities moved over, then packing my old apartment, then planning out where things go, and ultimately making the house a home.

It was physically exhausting to move two people’s belongings over – especially went the cheap route to rent a U-Haul. I answer to no one. I am my own landlord (excluding Fannie Mae). It’s a big responsibility to own a house. Every other week or so, I work on little things inside and outside the house. When I complete something, there’s another good idea for next week. Every month, I pay myself back one installment of 360 towards making it mine and living it comfortably for the next half-century or so. And so far, the housing market continues to appreciate, and I am grateful for this house and what it means to me.

I had a good experience with my lender, Academy Mortgage, where Shane Hollenback was my loan officer. He was direct, kind, and straightforward. When I had questions, he and Gabe were prompt and complete in addressing them.

My experience with my realtor, Shar Rundio, was excellent. They both serve the Phoenix area, and I am comfortable recommending them to others. If you don’t get to work with them, be sure that your lender and realtor demonstrate such strong characteristics and advocacy for you, a first-time homebuyer.

My advice for millennials on buying your first house

I know you’ve heard it before, but you need to save your money. Save your money. But there are many more factors in buying a house than liquid capital. Here is my advice for folks like me who want to buy a house.

DOWN PAYMENTS

A common misconception that I held is that to buy a house, you have to come to the table with 20 percent down. On a $200,000 house, that would mean $40,000 would need to be available in cash. The truth is you don’t need to have this much for a down payment, or even close to it. But you do have to have your financial ducks in a row so you can determine how much house you can afford.

Know that it will affect the payments you make, but honestly, not all that much. Come to the table with some skin in the game, but don’t bail yet if you don’t have a Lexus sitting in your savings account.

KNOW THE COST OF A MORTGAGE

Another belief I wrongly held is that mortgages are very expensive. While variables such as the interest rate, and down payment, and more affect the final purchase price, it doesn’t substantially change the monthly payments by much. And depending on the price of the home, your monthly payments will be probably similar to what you pay in rent. Don’t be misled by those teaser rates shown on many real estate sites – those are simply suggestions.

Do your research and don’t be afraid to meet with a mortgage lender to go over various examples that match your financial situation. Costs you need to factor are property taxes, homeowner’s insurance, mortgage insurance, and any homeowner’s association dues that might apply. As I told my lender, I want to know the “out the door” price as if I was buying a set of tires.

KNOW THE TRUE COST OF BUYING A HOUSE

Unlike a mortgage, you need to be familiar with all the extra costs in the buying process. Understand that there are a handful of fees for inspectors, appraisers, credit checks, and of course, closing costs. Some of these are negotiable but make sure you understand them. Don’t be surprised, so ask ahead so you can budget accordingly.

BE PATIENT

The buying process as you can imagine isn’t necessarily quick. I was lucky to have expedited the deal but plan to spend at least a few months searching for the home and securing financing. Sleep on big decisions. And if you’re living with a significant other, discuss not only your decisions but why you made them and how they make you feel. It was nice to have a successful realtor and lender that worked with me and didn’t get pushy or aggressive.

Look at this as an opportunity to learn and make the best possible decision with the most amount of data currently available.

KNOW YOUR CREDIT

I am grateful to have learned all about credit scores and the laws surrounding debt collection and reporting practices several years ago. Since then, I have developed a rigorous discipline to maintain my credit responsibly. Before you even think about buying a house, you had better know your FICO scores and remedy any issues. Your mistakes from the past are always correctable, and you are in control of it. If you have issues, invest the time to get your FICO scores above 720.

A little skeleton appeared from my distant past, but I resolved it just in time for the lending process. A service like Credit Karma has great advice and a forum like MyFICO also is a great place to visit to learn more.

INSPECT EVERYTHING

Even though I hired an inspector and he was good, there are always additional areas that are missed and not necessarily within the purview of the inspector’s duties. You are your advocate, so inspect the house top to bottom to spot any major issues and stand firm on any major work that has to get repaired. One example is that I had unshielded wires running through my kitchen island that would have sent me flying across the room. I missed that, and that responsibility is now mine.

Once you sign the deal, the house is yours for better or worse – spot the issues now and make a stink out of them before you sign.

PLAN FOR LARGE EXPENSES

Unlike a rental, you will find that you have a lot more committed to doing things right and not necessarily cheap. You will have expenses that you didn’t account for earlier in the purchase, so be ready to handle these.

Using your credit cards are perfect for this, especially if they have rewards for spending, so long as you pay them off no longer than a month down the road.

As funny as it is, we didn’t think about buying blinds until we were given the keys.

BUY A HOUSE FOR TOMORROW

If you’re used to living in 900 square feet, having twice that feels like a lot. I think it’s a prudent idea to buy a house that matches your lifestyle in the next few years. I did pay a bit more than I was initially comfortable with, but I was able to purchase a house that will reasonably last me for many, many years. And I feel good about that. But don’t get too optimistic.

Stay within your financial boundaries so you are ready for whatever the future has in store. It’s very easy to justify a bigger house, but be realistic.

CONSULT WITH A TRUSTED LENDER & REALTOR

This is one of the biggest financial decisions you’ll make, so it’s worth developing relationships with people you can trust. Reputation is everything in this world, so ask around and do your research online. Be assertive to explain what you want and need. They will match your pace in the deal and complement your style, so you are confident in your decisions. I was okay asking them to explain certain pieces of information until I understood. They should be at ease that you’re taking their time seriously and want to learn, so you make the best decision possible.

In the end, you will be happy that you made an informed decision about where you live. I don’t claim to be an expert on this – I’m not – but I hope this post offers some transparency into what my experience was like buying a house. I glossed over some details, but nevertheless, it is a journey.

After you buy a house, guess what? You’ll still have to save and keep on maintaining financial discipline. Store many months of expenses and pretend the cash doesn’t exist. In my case, I wasn’t as financially optimized as I probably should have been, but it all worked out great, and I am sleeping comfortably. I don’t think everyone has to be “perfect,” but you should be in a “fit” condition and be acutely aware of your finances and credit scores.

Good luck with your adventures in buying a home!

Photo credit